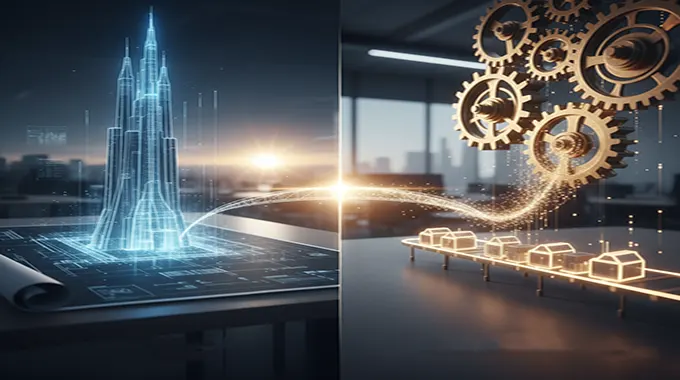

Corporate finance relies on two indispensable pillars for resource allocation: Capital Budgeting and Working Capital Management (WCM). While both aim to maximize shareholder value, they operate on vastly different scales. Capital Budgeting is the critical process of evaluating and selecting large, long-term investments, such as acquiring new machinery, building a new plant, or initiating a major expansion project, all of which are expected to generate returns over an extended period. In contrast, Working Capital Management is the management of a company’s current assets (like cash, accounts receivable, and inventory) and current liabilities (such as accounts payable and short-term debt). Its goal is to optimize day-to-day liquidity and operational profitability.

Time Horizon and Objectives

The core difference lies in the financial timeline and ultimate objective. Capital Budgeting decisions are inherently Long-term, typically spanning five years and often decades. Its objective is strategic: to maximize shareholder wealth through foundational growth, market expansion, and establishing a sustainable competitive advantage. It is heavily focused on assessing future earnings potential. WCM, conversely, operates on a Short-term horizon (daily, weekly, monthly, up to one year). The operational objective of WCM is to ensure immediate short-term liquidity and solvency, optimize operational efficiency by minimizing the holding costs of current assets or liabilities, and maximize current profitability. Its primary focus is on maintaining stable, predictable cash flow stability.

Risk and Decision-Making Tools

The nature of the investment dictates the risk level and the tools used for analysis. Capital Budgeting involves High Risk because the investments are large, typically irreversible, and depend on economic and market conditions over very long periods. The primary analytical Tools used are discounted cash flow techniques, including Net Present Value (NPV), Internal Rate of Return (IRR), and the Payback Period, all of which inform strategic decisions that shape the company’s future direction. WCM carries a comparatively Lower Risk in any single transaction, but the cumulative impact on liquidity and solvency can be severe if ignored. Operational Tools include the Cash Conversion Cycle (CCC), inventory turnover ratios, Days Sales Outstanding (DSO), and the Current Ratio. These metrics drive tactical, operational decisions vital for day-to-day viability.

Interdependence and Conclusion

Despite their contrasting time horizons, Capital Budgeting and Working Capital Management are profoundly interdependent. A highly promising capital budgeting project, such as building a state-of-the-art factory, can be jeopardized by poor WCM—specifically, a lack of operating cash to fund necessary payroll, raw materials, and initial inventory. Conversely, successful long-term capital projects will eventually impact WCM, leading to changes in inventory levels, increased receivables, or new financing needs. Both are indispensable for sustainable financial health. Capital Budgeting dictates where the company is going, providing the long-term vision, while Working Capital Management ensures the company gets there smoothly and profitably, navigating the day-to-day realities. Businesses must master both disciplines for sustained financial health and growth.